Among the various investment options for women in different asset classes, fixed deposits (FDs) have been gaining a lot of traction.

This is due to FDs being latent to market volatility and offering guaranteed returns. Given below are a few reasons prompting millennial women to invest in FDs.

1. High Market Returns

Millennial women are increasingly preferring financial products offering high returns. Though falling FD interest rates have been a cause of concern, new-age fixed deposits for women, from non-banking finance companies (NBFCs), are not only offering higher returns than the market average, but these deposits come with flexible tenors to suit liquidity needs at different stages of life.

For instance, Bajaj Finance Fixed Deposit offers an interest rate of over 8%, which is much higher than those offered by banks. A high rate of interest results in a higher maturity amount. The table below highlights the fact:

| Amount | Rate of Interest | Tenure | Maturity Amount |

| Rs. 2 lakh | 8.4% | 2 years | Rs. 2,36,448 |

| Rs. 2 lakh | 6.5% | 2 years | Rs. 2,27,685 |

Millennial women can use this FD calculator to know the maturity amount on their investment.

2. Flexible tenor

Millennial women face a different kind of financial music. Most of them take a break, for at least 2-3 years, from work post-child-birth to raise their kid(s). During these years, they lose out on their regular source of income. However, FDs for women come with a flexible tenor that put their money to good use even when they aren’t earning.

For instance, Bajaj Finance Fixed Deposit comes with a flexible tenor of 12-60 months that help millennial women meet their liquidity needs.

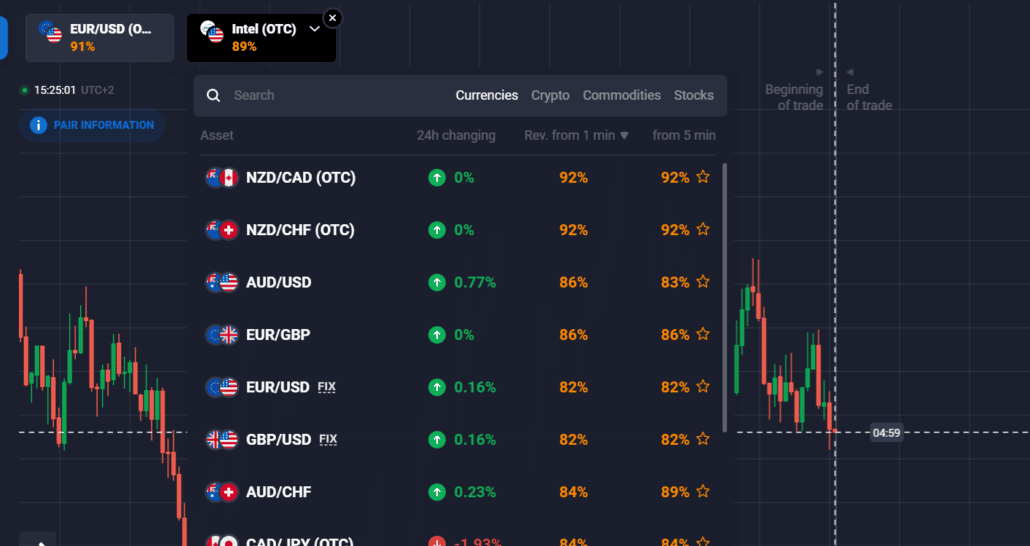

3. Latent to market volatility

This USP of FDs has continued further driven the millennial women into investing into them. Unlike equities or share market, where returns are not guaranteed and can be affected by the market dynamics, FDs offer assured returns.

It essentially means that the gains are not eaten away by market swings and the maturity amount doesn’t deplete even during the bearish phase. Offering a peace of mind, FDs continue to offer guaranteed returns.

4. Can be easily liquidated

For millennial women, the concept of financial goals goes beyond purchasing a home, saving for children’s higher education or planning one’s own retirement. Vacations, buying home décor items, celebrating various life events with pomp and show, etc., form an essential part of their life goals.

Since FDs can be easily liquidated, i.e., they can be broken prior to maturity, they offer instant funds to address their above-mentioned needs. When it comes to liquidity, FDs easily score over other asset classes. Liquidating certain assets such as mutual funds within a short span of time doesn’t serve the purpose as it doesn’t allow the power of compounding to work its magic.

5. Easy to understand and book

Financial prudence calls for a thorough understanding of financial instruments prior to investing. FDs are one of the easiest financial instruments to understand and book. Millennial women can book an FD from the comforts of their homes and offices online.

Most financial institutions today offer an online facility whereby one can book an FD by filling up the required details. The entire process can be completed within a few minutes.

6. Making investments without realising financial goals

On most occasions, the tax-saving attributes of a financial instrument guide investment decisions made by couples. However, investments should align with financial goals and not be guided by their tax-saving abilities. For instance, most couples end up investing in financial instruments that incur long-term liabilities in form of hefty premiums for 10-15 years. Financial goals should ideally be divided into two buckets – short and long-term.

FDs are a prudent investment option to invest for short-term goals like going on a vacation, purchasing a car, making a down payment for a house, etc. On the other hand, equity mutual funds are ideal investment avenues to accumulate wealth for long-term goals such as higher education of children.

7. Not buying life and health insurance

Due to its protection, savings and investment qualities, life insurance is one of the most robust financial instruments. Couples, especially in single-income households, often ignore the importance of life insurance. Ideally, couples must have a term insurance policy as it offers a large cover at affordable premiums.

It’s equally important to have a health insurance policy as healthcare expenses are rising, with medical inflation further pushing up costs. A family floater plan is ideal as it covers all the members of a family.

Also, couples must discuss matters related to finances among themselves before zeroing on any decision. A healthy discussion on money matters goes a long way in making an intelligent choice.